I can hardly believe that we are approaching our third year as homeowners. I couldn't even imagine past the first month, but here we are! That's three challenging but extremely rewarding years of memories pumped right into our 3-bed semi-detached house in a small working-class town in Lancashire. I realised that I haven't actually shared loads about "where we're at", the classic life updates have been few and far between - that's been an organic reaction to how we create and consume content on social media platforms. Instagam is indeed that, instant content - so while I may be concentrating my day-to-day more on IG it's still mega rewarding to bash out a few hundred words every now and again on my blog.

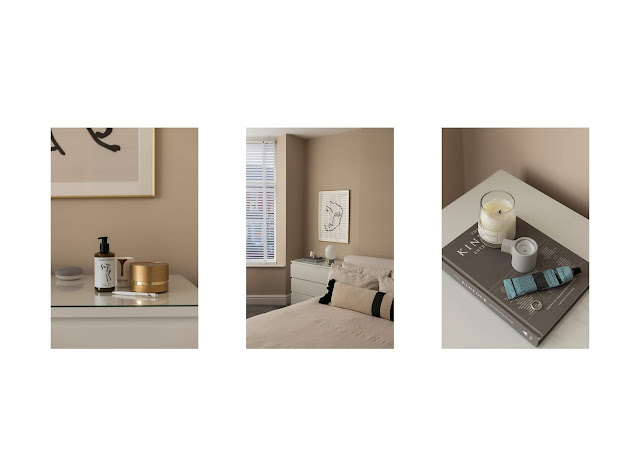

So much has changed in our house in (nearly) three years. There's a heck of a lot to be proud of; we redecorated our lounge, bedroom and downstairs bathroom, converted the wrecked garage into a functioning utility and the biggest achievement of all, we totally transformed our overgrown, tired back garden into a space that we are unbelievably happy with. Still a work-in-progress though.

Next on our list is to renovate our open-plan living room / kitchen / dining room area - but that all comes with time. We're just planning and saving for the right moment.

I'd like to start this piece by explaining our circumstances. We decided to buy a house in a small town instead of moving to one of

the bigger cities in the UK. This enabled us to afford the type of property we

just wouldn't have been able to afford otherwise. Hollie works full time as a university lecturer, and I work full time as a freelancer creative in the fashion and lifestyle industry.

There's somewhat murky grounds with how much (and generally just "how") freelancers in the creative industry earn, and how they afford to live their lifestyle. It's not a subject widely discussed. If we skip back to the time me + Hollie were applying for our mortgage, it quickly became clear just how unknown my job role was to people outside of the same industry. The conversations we had with our mortgage broker + several banks would make for interesting listening...but we did get accepted! A somewhat milestone achievement at the time, for what is now commonly known as "an influencer".

We put a good sized deposit down on our first house (around 15%), one that I'd had in a savings account - similar to The Nottingham's 18-39 Lifetime ISA - since I was 18-years-old at art collage, then moved in shortly after. We had very little furniture and appliances, but we made it work. Being scrupulous with money is a quality that has been past down to me from my grandad, who was my main father figure when growing up. I didn't realise it at the time, but a lot of his mannerisms and personality traits rubbed off on me, and as boring as it sounds I now consider my attentiveness with saving and budgeting to be one of my strong points.

Currently I have a good relationship with money, but that hasn't always been the case. It's a weird subject after all, we don't talk about it much do we? It's not nice when someone calls you "tight" when you think you're actually being considered, but realising you don't always have to be watching your wallet, when you can afford to do some of the things you want to do was a huge realisation moment for me. And that all comes down to sensible budgeting.

Owning a property is a huge responsibility, but with that comes a massive amount of satisfaction. By setting some budgeting ground rules from the off and sticking to them as much as we can we have been able to afford to slowly renovate our house without cutting corners, take a summer holiday aboard each year, treat ourselves to homeware and clothing when it feels right, all the while not feeling like we're on first-name-terms with beans on toast.

My routine is to put as much as feels comfortable into my savings account per month. There's no set amount as such, as I never really know much much I've got coming in (those late invoices...). It's worked well so far!

How we Make Savings in Other Ways

Saving isn't just about how much you've got in your account, it's how we're savvy in other ways which enables us to feel like we're not overspending or pushing our limits. Here's a few things that spring to mind, things we do weekly:

- We both LOVE craft beer. It can be pricey but I consider it totally worth it. We'll buy beer from our local shop to drink it at home instead of going to the pub. I take great satisfaction from cracking open a cold one in our living room.

- Cooking at home. We buy 80% of our food from ALDI, which effectively cuts our food bill down by half to what it would be if we did our weekly shops at Tesco or Sainsburys. We also buy little and often instead of one big shop per week - this helps minimise wasted food. The meals we cook always turn out top notch and we get adventurous with the recipes.

- As part of my job role (as in blogger / infleuncer) in I am fortunate enough to regularly receive clothing, homeware and sometimes hotel rooms for discounted prices or for free. This plays a big into factor for my month expenditure, but often these perks are considered as "payment" for certain jobs. A great perk, but it still involves the work a regular job would require.

- Smart meters are our best friends. Once our smart central heating hub learnt to our daily routine it started to regulate the times it switched itself on (to keep things topped up, rather than heating from a low temp) and maintaining a comfortable level. We save £50+ per month compared to our old traditional boiler system.

- DIY. Nearly all of our home projects have been done by ourselves (that me, Hollie and her dad). My father-in-law Neil really does have the "dad knowledge", he's helped us tremendously. We've build a wind-resistant fence, dug out an overgrown garden, tiled the porchway, changed electrics, laid and fixed floorboards, sanded the hallway, build a garden gate and dining room table from scratch, fixed cracks, fitted blinds, coving and shelving, painted each room and created insulation walls in the garage. I can't even imagine how much we have saved by doing this ourselves!

Having my head firmly in-tune with a savings routine since I was a teenager has helped, but it's never too late to start. There's loads of things that can help at any stage; from first time buying, making putting money aside for a couple of trips away a year easier, investing in furniture that will last a lifetime or saving for future retirement. Taking full advantage of incentives such as the 25% government bonus within The Nottingham's Lifetime ISA account means you can accumulate an extra £1000 per year on your savings - this account can be used to buy your first time and then continue the use to save for retirement.

Essentially, if you opened an account at 18, you could receive £32k from the government, for totally free, if you’ve saved £4,000 a year until you were 50. That's the max, but it's always best to be realistic and stay within your means when putting money aside.

Pension plans don't really sound so sexy, but nothing should discourage the importance of thinking about stuff like this and actually talking about it. As I mentioned earlier, money is a tricky subject to chat about, but more and more I find myself talking to by buddies about it - we're slowly learning what we can charge clients for projects, keeping rates competitive in line with how the industry is evolving and smart ways we can saving money each month which fit with our own personal circumstances.

Our house is constantly involving, as is the industry, my creative work and our home. It's slowly becoming the place we have always wanted to create; something I look forward coming back to, spending quiet time in, throwing diner parties, or watching wrestling on the big telly with a cold beer.

Our personal journeys all come with hard work and planning - and a lot can be gained from considering the bigger picture from an early age. My grandad past away when I was only 15, but the influence he had on my far surpasses the amount of years I knew him. It feels right to be passing this knowledge on to those of you who have stuck with me.

Thank you for reading!

Mat.

Thank you for reading!

Mat.

Thank you so much for sharing! I have also been lucky to have a father figure who encouraged me to open up savings accounts and whatnot as early as he could convince me to. I'm nowhere near a house just yet (especially not in Toronto - it's wild here) but it is a great comfort even just knowing I have it there for when I do want a house. My guy is also very very handy so we'd def have a DIY'd home of our own too some day! :)

ReplyDeleteThanks for joining the conversation Katia. Nice to hear from you again! I think it's been so important for me too, just those little pieces of advice passed down have been invaluable to me. It's all a learning curve.

ReplyDeleteDIY is the way! Are prices really mad over there?

Best Quality Beard Grooming products|Beard Grooming kits|The Beard Shop

ReplyDeleteWe sell top quality Beard Grooming kits,Beard Oil,Beard wax,Beard Treatments,Aprons,Combs,Beard Trimmers,Blades,Beard Hoodies,Beard Tshirts,Beard Beanies

The beard shop